Novel way to predict stock movements using multiple models and comprehensive analysis: leveraging voting meta-ensemble techniques

Keywords:

Stock prediction, Machine learning, Voting, Meta-ensemble, Predictive modelingAbstract

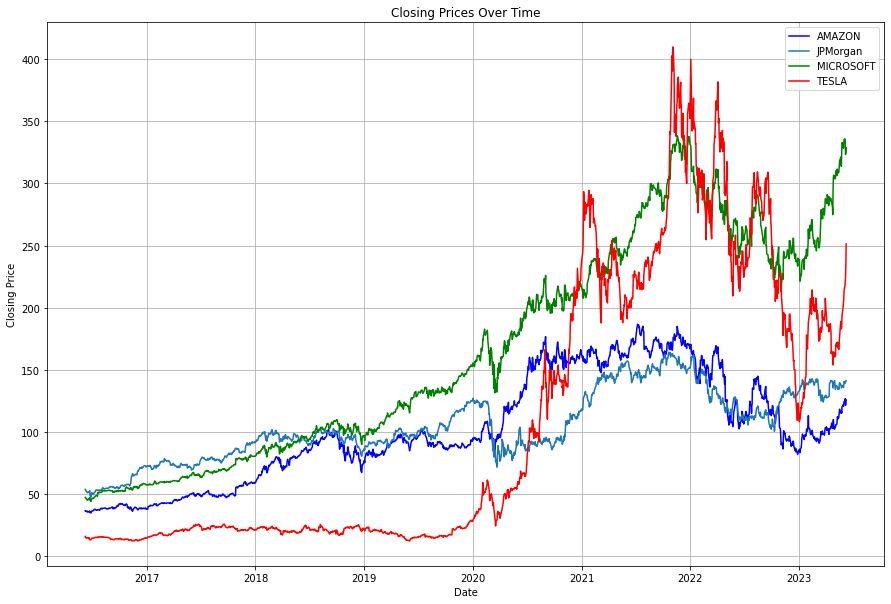

The research introduces a method for anticipating stock market patterns by combining machine learning techniques with analysis methods. Multiple machine learning algorithms were integrated to address the limitations of stock market forecasting models. Using web scraping techniques, data were gathered from the S&P500 index over seven years, from September 5, 2016, to August 5, 2023. Companies like Microsoft Corporation (MSFT), Amazon.com Inc. (AMZN), JPMorgan Chase & Co (JPM), and Tesla, Inc. (TSLA) were selected based on their inclusion in the S&P 500 index. LR, RF, SVC, ADAB, and XGBC algorithms were applied as models by utilising optimisation using grid search and single algorithm approaches. Voting methods were employed to combine predictions from these models. The study employed rigorous statistical analyses, including the Kruskal-Wallis test to assess overall differences, followed by Pairwise Dunn’s Test with Bonferroni Correction for detailed algorithm comparisons. Additionally, Bootstrapping was utilised to calculate Confidence Intervals (CI) for robust estimation of algorithm performance. The methodology covered data collection, preprocessing, model training, and performance assessment. The outcomes indicate that the proposed approach accurately forecasts stock trends precisely and dependably. This study contributes to refining stock market prediction methodologies by introducing a strategy that enhances prediction accuracy while offering investors and financial professionals insights. Furthermore, assessing algorithm performance across metrics and companies highlights the versatility and effectiveness of machine-learning approaches in the fields.

Published

How to Cite

Issue

Section

Copyright (c) 2024 Akila Dabara Kayit, Mohd Tahir Ismail

This work is licensed under a Creative Commons Attribution 4.0 International License.