Deep neural network model for vertical total electron content prediction at a single low latitude station

Keywords:

Deep learning neural network, TEC model, Solar activity proxy, NeQuick 2Abstract

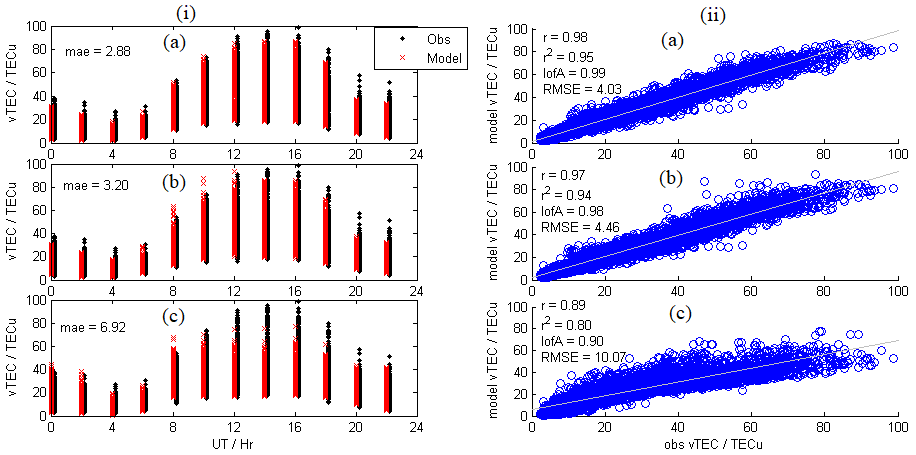

Modeling ionospheric parameters at low and equatorial stations is quite challenging due to the nature of the variation in the region. In this study, a Deep Neural Network (DNN) was configured via optimization of its hyperparameters and then trained to predict vertical Total Electron Content (vTEC) at a single low latitude location. Input parameters to the model are universal time, day of the year and solar activity index (EUV / ), while the target parameter is vTEC at a single location. EUV and values were used separately as the solar ionizing index leading to two trained models. The data used for training were for the solar cycle 24 and the data were split into 75 % for training and 25 % for validation. The training process was completed by the number of iterations. In addition, the derived model was also validated using data for the whole of 2000 and 2021 which are years outside the solar cycle 24. For completeness, the two models were also compared with NeQuick 2 model which is a global empirical model. The results obtained showed that the DNN models were able to predict reasonably well within the solar cycle 24 and slightly outperformed NeQuick 2 model. Similar results were obtained when the models were validated in 2021 with DNN slightly performed better that NeQuick 2 model. However, large deviation was recorded in 2000 – the DNN and NeQuick 2 models underestimated vTEC.

Published

How to Cite

Issue

Section

Copyright (c) 2025 F. U. Salifu, O. A. Oladipo, E. O. Ebock, B. Nava (Author)

This work is licensed under a Creative Commons Attribution 4.0 International License.