On the Investment Strategy, Effect of Inflation and Impact of Hedging on Pension Wealth during Accumulation and Distribution Phases

Keywords:

Hedging, constant relative risk aversion (CRRA), constant absolute risk aversion (CARA), Defined Contribution (DC), Constant elasticity of variance (CEV), optimal strategyAbstract

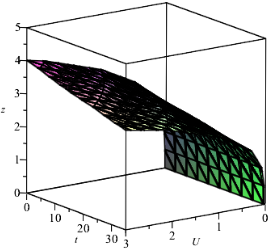

This paper studies the various results obtained in literature on the investment strategy, the effect of inflation and impact ofh edging on the Pension Wealth generation. The explicit solution of the constant relative risk aversion (CRRA) and constant absolute risk aversion (CARA) utility functions are obtained, both in the accumulation and distribution phase, using Legendre transform, dual theory, and change of variable techniques. It is established herein that the elastic parameter (beta) is not equal to one (beta neq 1), based on the assumption of our model. Theorems are constructed and proved on the various wealth investment strategies. Observations and significant results are made and obtained, respectively in the comparison of our various utility functions and some previous results in literature. Sensitivity analysis and Simulations on the various utility functions and optimal strategies during the accumulation and distribution phase are presented; when the existence of a elastic parameter that is not equal to one, when there is existence of modifying factors, when there is need for diversification of investment, when there is no significant effect of the choice of risk aversion strategy on investment returns during inflation period, when there is hedging ability of Inflation indexed Bond and Inflation-linked Stock and when there is insignificant effect of the orthogonal relationship between stock and time and nonpayment of pension benefits on the satisfaction of the investors.

Published

How to Cite

Issue

Section

Copyright (c) 2020 Journal of the Nigerian Society of Physical Sciences

This work is licensed under a Creative Commons Attribution 4.0 International License.