Portfolio Strategy for an Investor with Logarithm Utility and Stochastic Interest Rate under Constant Elasticity of Variance Model

Keywords:

Stochastic interest rate, optimal portfolio strategy, asymptotic technique, constant elasticity of variance, logarithm utilityAbstract

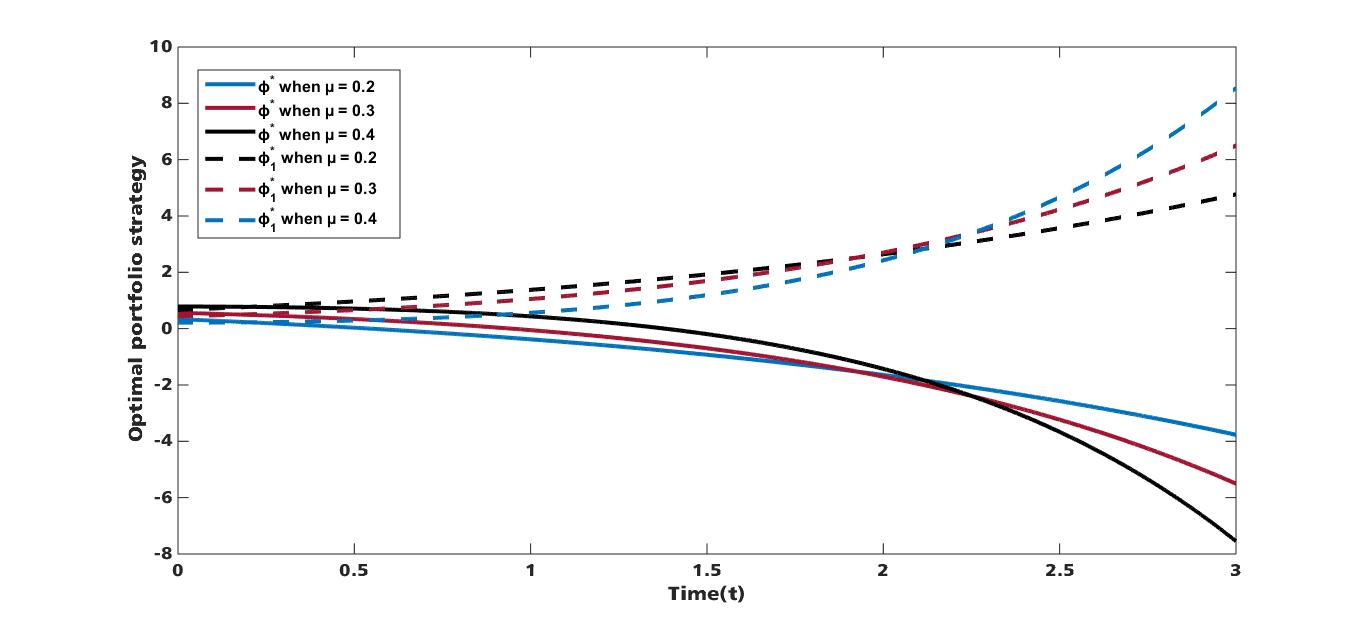

This paper is aim at maximizing the expected utility of an investor’s terminal wealth; to achieve this, we study the optimal portfolio strategy for an investor with logarithm utility function under constant elasticity of variance (CEV) model in the presence of stochastic interest rate. A portfolio comprising of one risk free asset and one risky asset is considered where the risk free interest rate follows the Cox- Ingersoll-Ross (CIR) model and the risky asset is modelled by CEV. Using power transformation, change of Variable and asymptotic expansion technique, an explicit solution of the optimal portfolio strategy and the Value function is obtained. Furthermore, numerical simulations are presented to study the effect of some parameters on the optimal portfolio strategy under stochastic interest rate.