Integrated data-driven credit default prediction in Uganda using machine learning models

Keywords:

SVM, XGBoost, Credit defaulter, Prediction model, Financial dataAbstract

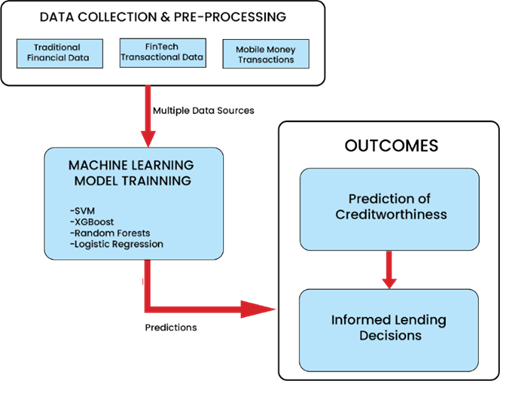

The prediction of credit facility defaulters is quite a challenge in Uganda, particularly for those without a formal banking history. Existing prediction models cater for prediction using conventional banking records which is not sufficient. The use of integrated data to cater for the unbanked population is required to further enhance financial inclusivity and stability in Uganda’s financial landscape. This study therefore aims at filling this gap by using machine learning techniques on a rich blend of financial data, including mobile money and Fintech (Financial Technology) services, as well as traditional banking records. Several machine learning algorithms used for loan default prediction were compared, such as Random Forest, Logistic Regression, Support Vector Machines (SVM), and Extreme Gradient Boosting (XGBoost). Random Forest Model showed 96.66% accuracy, 79.65% recall, 96.52% precision and 0.85 AUC. XGBoost model was found to have an accuracy of 95.23%; recall, 73.32%; precision, 94.11%; and Area Under the Curve (AUC) of 0.81. However, Random Forest performed best by all metrics with XGBoost following slightly. Logistic Regression showed 89.53% accuracy but had a very low recall at 43.24% and precision at 66.59%. SVM performed averagely with 93.21% accuracy and 62.80% recall all falling below that of XGBoost and Random Forest. Thus, the study revealed the significance of machine learning models like Random Forest and XGBoost for credit scoring prediction. Overall, it will improve the ability of institutions and policymakers to identify potential default borrowers so as to mitigate loan default rates and ensure economic growth in underserved communities through more accurate and inclusive credit evaluation tools.

Published

How to Cite

Issue

Section

Copyright (c) 2025 George Muddu, Shefiu Olusegun Ganiyu, Adekunle Olugbenga Ejidokun, Yusuf Abass Aleshinloye (Author)

This work is licensed under a Creative Commons Attribution 4.0 International License.