Analysis of a Stochastic Optimal Control for Pension Funds and Application to Investments in Lower Middle-Income Countries

Keywords:

Pension, stochastic, control, risky asset, parametersAbstract

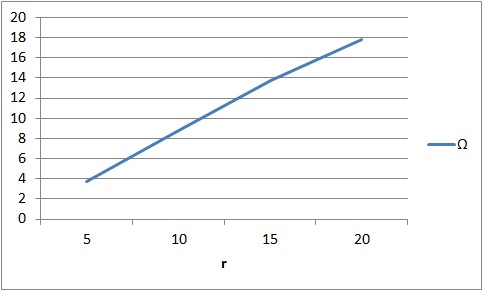

One of the major problems faced in the management of pension funds and plan is how to allocate and control the future flow of contribution likewise the proportion of portfolio value and investments in risky assets. This work considers the management of a pension plan by means of a stochastic dynamic programming model based on Merton's model. The model is analyzed such that the conditions of optimal contribution and investment in risky assets are determined and sensitized. The case study of Nigeria, Ghana, Kenya is considered for various periods in the model simulation. Thus, the volatility condition obtained is used to estimate the efficiency of some important parameters of the model.

Published

How to Cite

Issue

Section

How to Cite

Similar Articles

- Edikan E. Akpanibah, Udeme O. Ini, An Investor’s Investment Plan with Stochastic Interest Rate under the CEV Model and the Ornstein-Uhlenbeck Process , Journal of the Nigerian Society of Physical Sciences: Volume 3, Issue 3, August 2021

- Edikan E. Akpanibah, Udeme Ini, Portfolio Strategy for an Investor with Logarithm Utility and Stochastic Interest Rate under Constant Elasticity of Variance Model , Journal of the Nigerian Society of Physical Sciences: Volume 2, Issue 3, August 2020

- J. Andrawus, J. Y. Musa, S. Babuba, A. Yusuf, S. Qureshi, U. T. Mustapha, A. Oghenefejiro, I. S. Mamba, Modeling the dynamics of pertussis to assess the influence of timely awareness with optimal control analysis , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 4, November 2025

- Olusegun Olotu, Charles Aladesaye, Kazeem Adebowale Dawodu, Modified Gradient Flow Method for Solving One-Dimensional Optimal Control Problem Governed by Linear Equality Constraint , Journal of the Nigerian Society of Physical Sciences: Volume 4, Issue 1, February 2022

- Fatmawati, Faishal F. Herdicho, Nurina Fitriani, Norma Alias, Mazlan Hashim, Olumuyiwa J. Peter, Optimal control strategies for dynamical model of climate change under real data , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 3, August 2025

- Opeyemi O. Enoch, Catherine O. Alakofa , Lukman O. Salaudeen , Odd Order Integrator with Two Complex Functions Control Parameters for Solving Systems of Initial Value Problems , Journal of the Nigerian Society of Physical Sciences: Volume 5, Issue 1, February 2023

- F. O. Aweda, J. A. Akinpelu, T. K. Samson, M. Sanni, B. S. Olatinwo, Modeling and Forecasting Selected Meteorological Parameters for the Environmental Awareness in Sub-Sahel West Africa Stations , Journal of the Nigerian Society of Physical Sciences: Volume 4, Issue 3, August 2022

- Josephine E. Ochigbo, Joel N. Ndam, Wipuni U. Sirisena, Optimal control with the effects of ivermectin and live stock availability on malaria transmission , Journal of the Nigerian Society of Physical Sciences: Volume 6, Issue 3, August 2024

- E. A. Nwaibeh, M. K. M. Ali, M. O. Adewole, The dynamics of hybrid-immune and immunodeficient susceptible individuals and the three stages of COVID-19 vaccination , Journal of the Nigerian Society of Physical Sciences: Volume 6, Issue 3, August 2024

- S. Alao , R. A. Oderinu, B. A. Sanusi, T. A. Oyeyinka, F. J. Ayanbukola, Computational investigation of magnetohydrodynamics Casson Micropolar fluid flowing past a permeable linearly stretchy wall with heat source , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 3, August 2025

You may also start an advanced similarity search for this article.

Most read articles by the same author(s)

- Tolulope Latunde, Joseph Oluwaseun Richard, Opeyemi Odunayo Esan, Damilola Deborah Dare, Sensitivity of Parameters in the Approach of Linear Programming to a Transportation Problem , Journal of the Nigerian Society of Physical Sciences: Volume 1, Issue 3, August 2019