Optimizing discrete dutch auctions with time considerations: a strategic approach for lognormal valuation distributions

Keywords:

Auctions, Lognormal distribution, Nonlinear programming, Discrete Dutch auction, Revenue optimizationAbstract

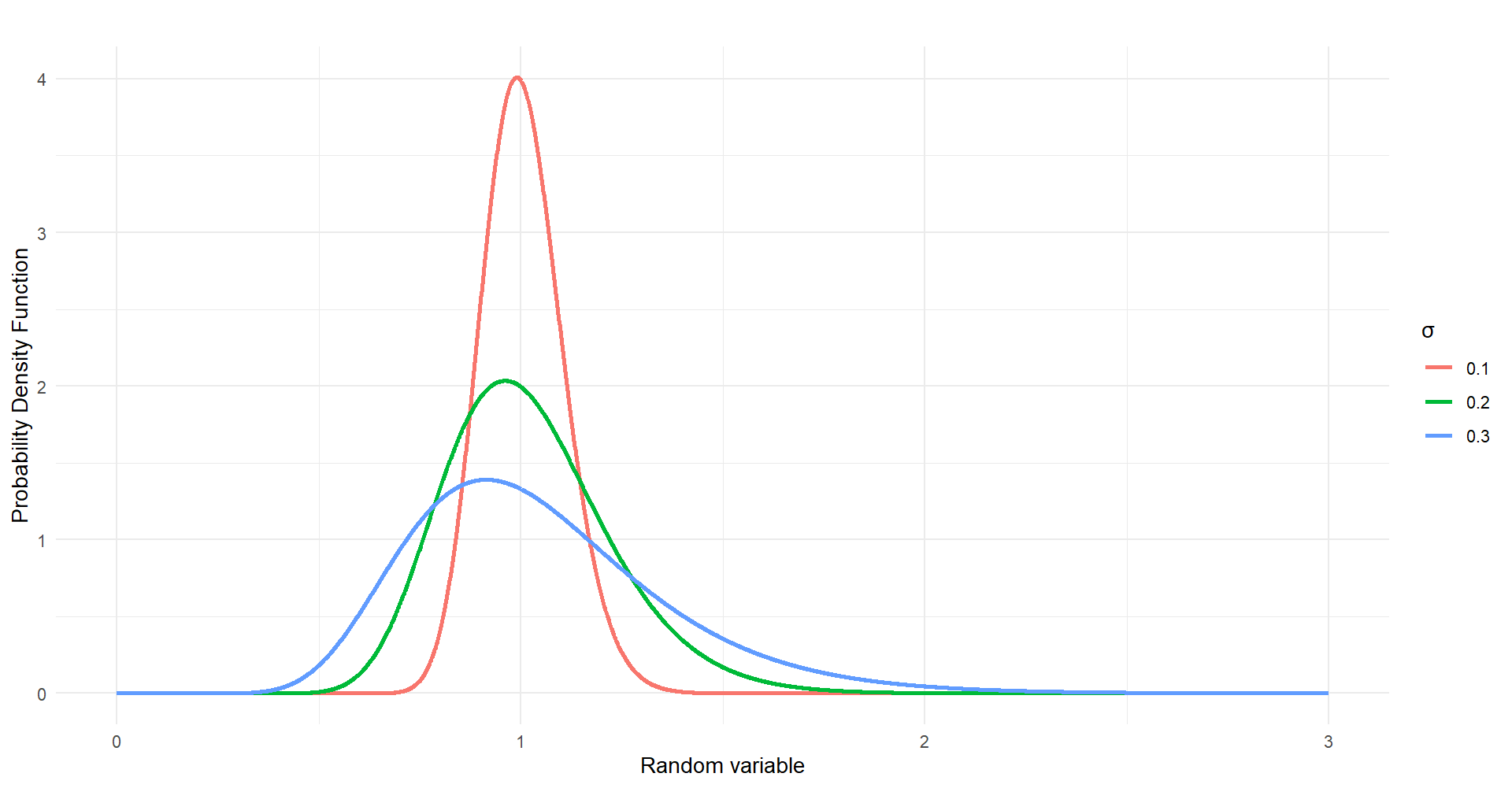

This research deviates from usual studies in auction literature primarily focused on maximizing expected revenue. Instead, we concentrate on the strategic design of discrete Dutch auctions in the context of bidder emotional attachment, wherein valuations follow a lognormal distribution. Our objective is to attain an optimal balance between the auctioned object’s selling price and the auction duration, ultimately maximizing the auctioneer’s expected revenue per unit of time. Our proposed models exhibit significantly higher average revenues per unit of time than counterparts neglecting time considerations and emotional attachment of the bidders. This achievement results from strategically reducing auction durations, enabling more auctions within the allotted time. This intentional trade-off ensures the marginal revenue decrease in shorter auctions is surpassed by the substantial increase in overall revenues from heightened auction frequency. Numerical results emphasize the utility of our modified discrete Dutch auction design, particularly in scenarios with a large number of bidders. Furthermore, increasing skewness in valuation distributions correlates with higher revenue per unit of time. Complete knowledge of the number of participating bidders is crucial, leading to a noticeable elevation in the auctioneer’s expected revenue per unit of time. However, the predictability of auction outcomes may be challenging, underscoring the nuanced nature of auction dynamics.

Published

How to Cite

Issue

Section

Copyright (c) 2024 Raja Aqib Shamim, Majid Khan Majahar Ali

This work is licensed under a Creative Commons Attribution 4.0 International License.

How to Cite

Most read articles by the same author(s)

- O. J. Ibidoja, F. P. Shan, Mukhtar, J. Sulaiman, M. K. M. Ali, Robust M-estimators and Machine Learning Algorithms for Improving the Predictive Accuracy of Seaweed Contaminated Big Data , Journal of the Nigerian Society of Physical Sciences: Volume 5, Issue 1, February 2023

- Xiaojie Zhou, Majid Khan Majahar Ali, Farah Aini Abdullah, Lili Wu, Ying Tian, Tao Li, Kaihui Li, Air quality prediction enhanced by a CNN-LSTM-Attention model optimized with an advanced dung beetle algorithm , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 3, August 2025

- Shaymaa Mohammed Ahmed, Majid Khan Majahar Ali, Raja Aqib Shamim, Integrating robust feature selection with deep learning for ultra-high-dimensional survival analysis in renal cell carcinoma , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 4, November 2025

- Paavithashnee Ravi Kumar, Majid Khan Majahar Ali, Olayemi Joshua Ibidoja, Identifying heterogeneity for increasing the prediction accuracy of machine learning models , Journal of the Nigerian Society of Physical Sciences: Volume 6, Issue 3, August 2024

- Shaymaa Mohammed Ahmed, Majid Khan Majahar Ali, Arshad Hameed Hasan, Evaluating feature selection methods in a hybrid Weibull Freund-Cox proportional hazards model for renal cell carcinoma , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 3, August 2025

- Nahid Salma, Majid Khan Majahar Ali, Raja Aqib Shamim, Machine learning-based feature selection for ultra-high-dimensional survival data: a computational approach , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 3, August 2025

- Chuchu Liang, Majid Khan Majahar Ali, Lili Wu, A novel multi-class classification method for arrhythmias using Hankel dynamic mode decomposition and long short-term memory networks , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 2, May 2025

- xiaojie zhou, Majid Khan Majahar Ali, Farah Aini Abdullah, Lili Wu, Ying Tian, Tao Li, Kaihui Li, Implementing a dung beetle optimization algorithm enhanced with multi-strategy fusion techniques , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 2, May 2025

- Ibrahim Adamu Mohammed, Majid Khan Majahar Ali, Sani Rabiu, Raja Aqib Shamim, Shahida Shahnawaz, Development and validation of hybrid drying kinetics models with finite element method integration for black paper in a v-groove solar dryer , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 4, November 2025

- Raja Aqib Shamim, Majid Khan Majahar Ali, Mohamed Farouk Haashir bin Hamdullah, Computational optimization of auctioneer revenue in modified discrete Dutch auctions with cara risk preferences , Journal of the Nigerian Society of Physical Sciences: Volume 8, Issue 1, February 2026 (In Progress)