Computational optimization of auctioneer revenue in modified discrete Dutch auctions with cara risk preferences

Keywords:

Auctions, Lognormal distribution, Nonlinear programming, Discrete Dutch auction, RevenueAbstract

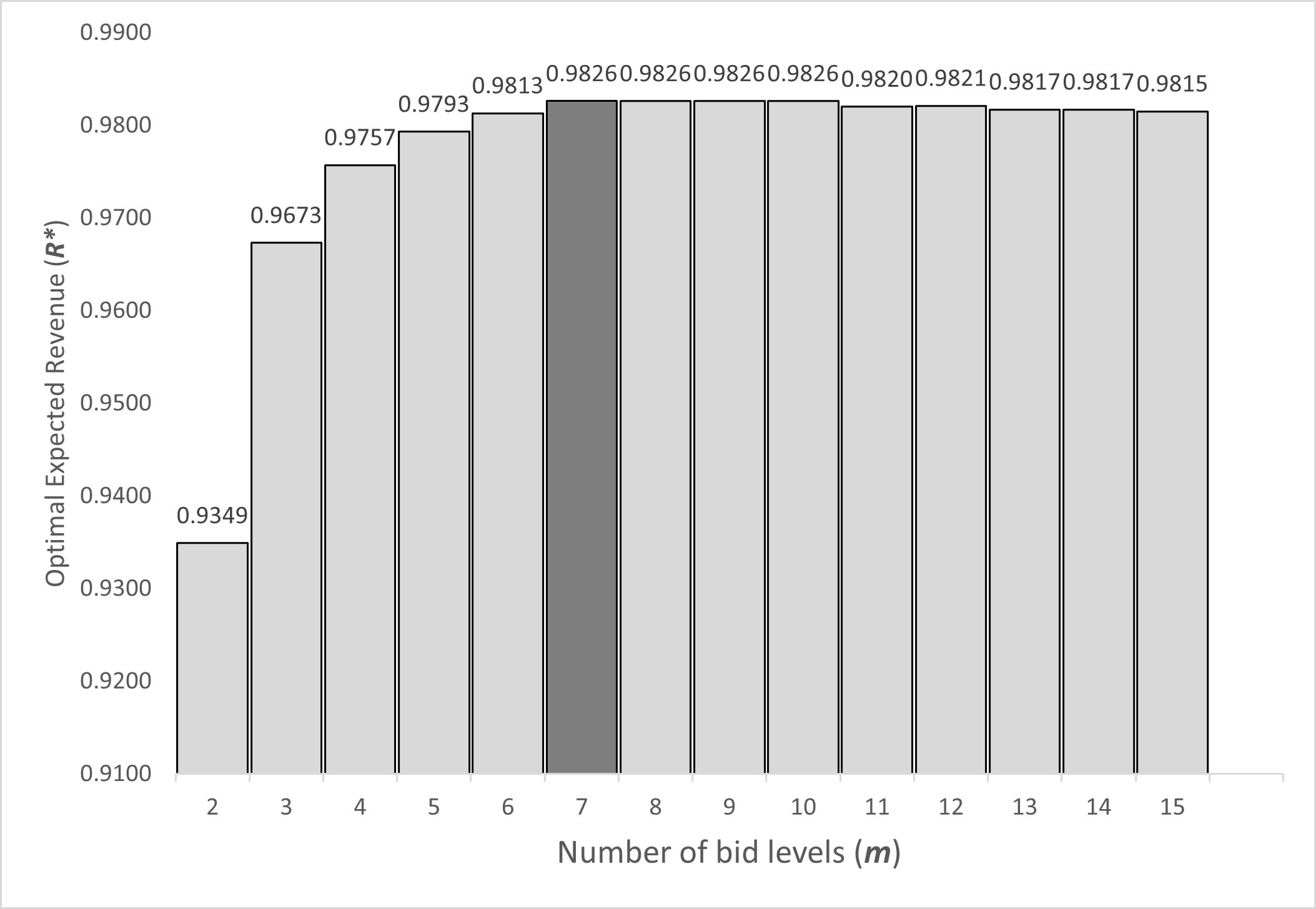

This research presents a computational optimization framework designed to maximize auctioneer revenue in modified discrete Dutch auctions by explicitly incorporating bidders’ risk preferences---modeled independently of wealth through the Constant Absolute Risk Aversion (CARA) utility function---thus enabling the analysis of risk-averse, risk-neutral, and risk-loving behaviors within the auction context. The study models bidders with three distinct risk profiles--risk-loving, risk-neutral, and risk-averse--employing nonlinear programming techniques to optimize expected revenues for the discrete bid levels. Discrete optimization methods are applied to analyze the impact of varying risk preferences, revealing that auctioneer revenue grows nonlinearly with bidder participation. For risk-neutral bidders (\alpha -> 0), revenue increases sharply from \mathscr{R}* = 0.3849 for n=2 to \mathscr{R}* = 0.8179 for n = 20 (a 112.5% increase), but the rate of growth declines significantly beyond n=30, with revenue plateauing near \mathscr{R}* = 0.9454 for n = 100 (a mere 9.5\% increase from n = 30 to n = 100). Similar patterns hold for risk-averse (\alpha > 0) and risk-loving (\alpha < 0) bidders, though the magnitudes differ. Moreover, risk-loving bidders (for \alpha = -0.5) yield \mathscr{R}* = 1.2122 for n = 100, a 28\% higher revenue than risk-neutral case with \mathscr{R}*= 0.9454 and a 61% higher than risk-averse case (for \alpha = 0.5) with \mathscr{R}*=0.7519. This nonlinearity suggests diminishing marginal returns to additional bidders, a critical insight for auction design. The findings suggest that for larger bidder groups, fewer bid levels are sufficient for revenue maximization, with risk-averse behavior decreasing expected returns and risk-loving behavior amplifying them. This computational approach highlights the critical role of risk preferences in auction design, offering a robust mathematical model that can be adapted for broader applications in algorithmic auction mechanisms.

Published

How to Cite

Issue

Section

Copyright (c) 2025 Raja Aqib Shamim, Majid Khan Majahar Ali, Mohamed Farouk Haashir bin Hamdullah (Author)

This work is licensed under a Creative Commons Attribution 4.0 International License.

How to Cite

Similar Articles

- Raja Aqib Shamim, Majid Khan Majahar Ali, Optimizing discrete dutch auctions with time considerations: a strategic approach for lognormal valuation distributions , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 1, February 2025

- John Tulirinya, Mathew Kinyanju, Samuel Mutua, Asaph Muhumuza, Optimizing initial chlorine dosage at an injection point along a water distribution pipe , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 4, November 2025

- T. S. Fagbemigun, M. O. Olorunfemi, S. A. Wahab, Modeling of Self Potential (SP) Anomalies over a Polarized Rod with Finite Depth Extents , Journal of the Nigerian Society of Physical Sciences: Volume 1, Issue 2, May 2019

- Olumide Sunday Adesina, Bayesian Multilevel Models for Count Data , Journal of the Nigerian Society of Physical Sciences: Volume 3, Issue 3, August 2021

- Umaru Hassan, Mohd Tahir Ismail, Improving forecasting accuracy using quantile regression neural network combined with unrestricted mixed data sampling , Journal of the Nigerian Society of Physical Sciences: Volume 5, Issue 4, November 2023

- F. O. Akinpelu, R. A. Oderinu, A. D. Ohaegbue, Analysis of Hydromagnetic Double Exothermic Chemical Reactive Flow with Convective Cooling through a Porous Medium under Bimolecular Kinetics , Journal of the Nigerian Society of Physical Sciences: Volume 4, Issue 1, February 2022

- Mariya Helen, Prabhakar V, Computational investigation of free convection flow inside inclined square cavities , Journal of the Nigerian Society of Physical Sciences: Volume 4, Issue 2, May 2022

- Adefunke Bosede Familua, Ezekiel Olaoluwa Omole, Luke Azeta Ukpebor, A Higher-order Block Method for Numerical Approximation of Third-order Boundary Value Problems in ODEs , Journal of the Nigerian Society of Physical Sciences: Volume 4, Issue 3, August 2022

- Uthumporn Panitanarak, Aliyu Ismail Ishaq, Alfred Adewole Abiodun, Hanita Daud, Ahmad Abubakar Suleiman, A new Maxwell-Log logistic distribution and its applications for mortality rate data , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 2, May 2025

- Yakubu Aliyu, Umar Usman, On Bivariate Nadarajah-Haghighi Distribution derived from Farlie-Gumbel-Morgenstern copula in the Presence of Covariates , Journal of the Nigerian Society of Physical Sciences: Volume 5, Issue 2, May 2023

You may also start an advanced similarity search for this article.

Most read articles by the same author(s)

- O. J. Ibidoja, F. P. Shan, Mukhtar, J. Sulaiman, M. K. M. Ali, Robust M-estimators and Machine Learning Algorithms for Improving the Predictive Accuracy of Seaweed Contaminated Big Data , Journal of the Nigerian Society of Physical Sciences: Volume 5, Issue 1, February 2023

- Xiaojie Zhou, Majid Khan Majahar Ali, Farah Aini Abdullah, Lili Wu, Ying Tian, Tao Li, Kaihui Li, Air quality prediction enhanced by a CNN-LSTM-Attention model optimized with an advanced dung beetle algorithm , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 3, August 2025

- Shaymaa Mohammed Ahmed, Majid Khan Majahar Ali, Raja Aqib Shamim, Integrating robust feature selection with deep learning for ultra-high-dimensional survival analysis in renal cell carcinoma , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 4, November 2025

- Paavithashnee Ravi Kumar, Majid Khan Majahar Ali, Olayemi Joshua Ibidoja, Identifying heterogeneity for increasing the prediction accuracy of machine learning models , Journal of the Nigerian Society of Physical Sciences: Volume 6, Issue 3, August 2024

- Nahid Salma, Majid Khan Majahar Ali, Raja Aqib Shamim, Machine learning-based feature selection for ultra-high-dimensional survival data: a computational approach , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 3, August 2025

- Raja Aqib Shamim, Majid Khan Majahar Ali, Optimizing discrete dutch auctions with time considerations: a strategic approach for lognormal valuation distributions , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 1, February 2025

- Shaymaa Mohammed Ahmed, Majid Khan Majahar Ali, Arshad Hameed Hasan, Evaluating feature selection methods in a hybrid Weibull Freund-Cox proportional hazards model for renal cell carcinoma , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 3, August 2025

- Chuchu Liang, Majid Khan Majahar Ali, Lili Wu, A novel multi-class classification method for arrhythmias using Hankel dynamic mode decomposition and long short-term memory networks , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 2, May 2025

- Ibrahim Adamu Mohammed, Majid Khan Majahar Ali, Sani Rabiu, Raja Aqib Shamim, Shahida Shahnawaz, Development and validation of hybrid drying kinetics models with finite element method integration for black paper in a v-groove solar dryer , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 4, November 2025

- xiaojie zhou, Majid Khan Majahar Ali, Farah Aini Abdullah, Lili Wu, Ying Tian, Tao Li, Kaihui Li, Implementing a dung beetle optimization algorithm enhanced with multi-strategy fusion techniques , Journal of the Nigerian Society of Physical Sciences: Volume 7, Issue 2, May 2025